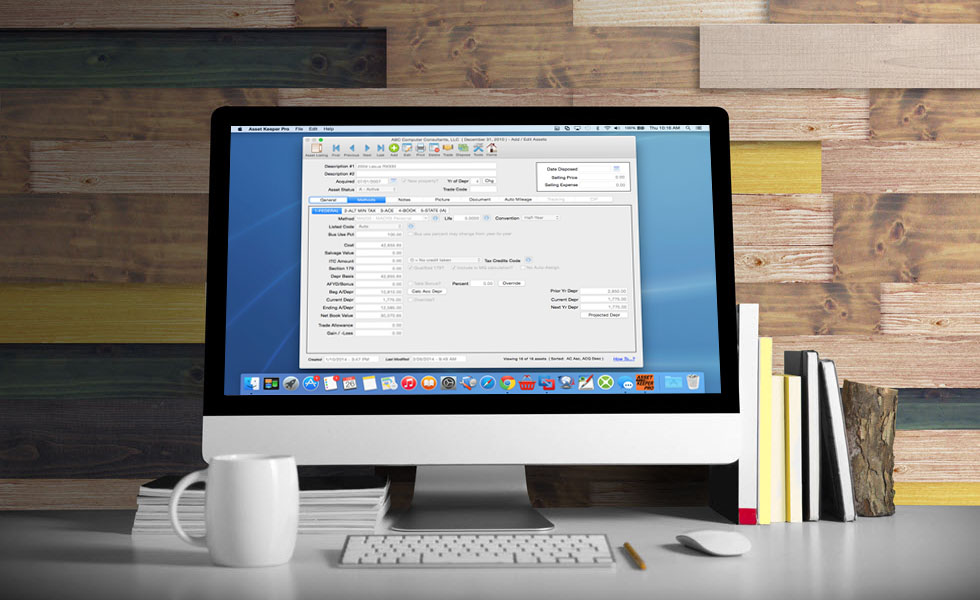

Asset Keeper Pro - Updated car and truck depreciation limits for 2021 and IL State Add-Back

The IRS has issued its annual inflation-adjusted update of depreciation limits for passenger automobiles, including trucks and vans placed in service in 2021. For vehicles (including passenger automobiles, trucks and vans), where first year bonus depreciation was claimed, the depreciation limits for year 1 is $ 18,200, year 2, $ 16,400, year 3, $ 9,800, and $ 5,860 for each succeeding year. For vehicles where first year bonus depreciation was NOT claimed, the depreciation limits for year 1 is $ 10,200, year 2, $ 16,400, year 3, $ 9,800, and $ 5,860 for each succeeding year.

Illinois decoupled from 100% bonus depreciation for year-ends ending 12/31/2021 or later. This change will require you to maintain a separate IL state method if you claim bonus depreciation for Federal. Follow the instructions in the “What’s New” to create your IL state method.